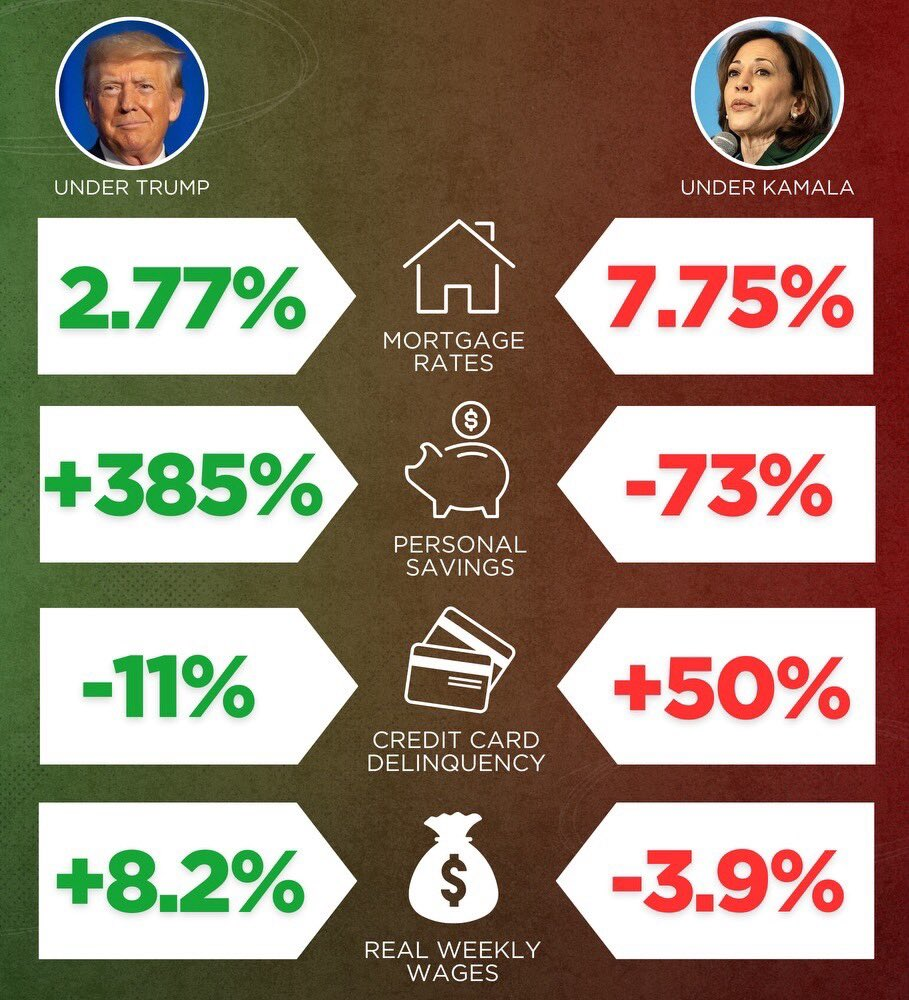

Sometimes, economic data can create a view for framing the performance of administrations through an image of key financial indicators that directly affect the lives of citizens. Indeed, in the image, a comparison is sharply made between two periods-under former President Trump and Vice President Kamala Harris. Of course, it shall be appropriate to note, as mentioned, that economic data under Kamala Harris would be representative of the broader Biden administration policies. So, let us delve into these numbers in detail to see what they can insinuate.

1. Mortgage Rates: 2.77% vs. 7.75%

The mortgage rates stood at 2.77%, strikingly low during Trump’s term in office, and thus very affordable for many Americans who were able to secure houses in their names by taking full advantage of the good conditions of borrowing money. On the contrary, current rates under Kamala Harris have surged upwards to 7.75%, indicating a massive leap. Generally speaking, higher mortgage rates dampen the rate of activities of home buying as it is not as easy for people to afford new homes or refinance the existing mortgages in their possession.

Why it matters: Higher mortgage rates reflect inflationary pressures and a shift in monetary policy by the Federal Reserve. When mortgage rates reach 7.75%, monthly payments are substantially higher, hurting household budgets and further reducing disposable income.

2. Personal Savings: +385% vs. -73%

Under Trump, personal savings soared 385%, no doubt fueled by tax cuts and low inflation and pandemic-era stimulus measures. Under Kamala Harris, it’s fallen 73%.

Why it matters: Increasing living costs, inflation, and economic uncertainty drive households to spend their savings. Such huge disparities in the rate of personal savings could indicate that Americans barely keep their financial protective buffers intact.

3. Credit Card Delinquency: -11% vs. +50%

Credit card delinquency-or failing to pay bills on time-decreased 11% during Trump’s presidency. Under Kamala Harris, the rate increased 50%.

Why it matters: An uptick in credit card delinquency typically reflects that people cannot pay down their debt in a timely manner and may be experiencing inflation or losing jobs. Often, this is indicative of a broader economic hardship in which the use of credit is being used more to finance daily consumption.

4. Real Weekly Wages: +8.2% vs. -3.9%

Lastly, under Trump, the real weekly wage increase-meaning wages adjusted for inflation-actually rose 8.2%, which indicates that workers could keep up with, if not expand, their purchasing power. Real wages have fallen 3.9% under Kamala Harris.

Why it matters: Falling real wages indicate that inflation is outpacing wage growth. Even as people might earn more in nominal terms, their capability to purchase goods and services has actually gone down. This may even cause worse living standards and increase the economic burdens of many.

Conclusion

These then highlight a dramatic change within the primary economic indicators: mortgage rates, personal savings, credit card delinquency, and real wages. As much as this data does indeed present a rather radical juxtaposition of two different points in time, it is important to broaden the perspective on the global and domestic contexts in which these numbers are being put forward. Economic conditions depend on a variety of factors that include disruptions to global supply chains, monetary policies, geopolitical tensions, and public health crises.

These two trends are, however, an eye-opener for both the policymaker and the common man. More forceful measures may then be required to ensure economic stability and growth if mortgage rates stay high continuously and personal savings decline further.

— Donald J. Trump (@realDonaldTrump) September 5, 2024